Most Profitable Investments in the Last 5 Years

Most Profitable Investments in the Last 5 Years

The stock market events of the last six months could be described as a roller coaster ride, where excessive investor optimism alternates with concerns and fears. Donald Trump and his new administration's decisions have had a significant impact on this investor sentiment, substantially shaking diplomatic ties, the global economy, and the previously established order. Moreover, the four-year presidential term is only at its starting line. Therefore, investors' question is justified - where currently is the least risk and greatest profit potential for investing?It's interesting to examine how different investment categories have performed over the past five years - from more conservative deposits to investments in stock markets. The following table summarizes the annual returns from seven different investment instruments, including not only investments in financial markets but also real estate and business loans. The sources for investment returns in global stocks, bonds, real estate, and deposits are the most popular index funds for these investment categories.

| 2020 | 2021 | 2022 | 2023 | 2024 | Average | Fluctuation | |

| Business Loans | 11.92% | 8.55% | 10.11% | 12.05% | 11.73% | 10.87% | 1.52% |

| Baltic Stocks | 11.27% | 42.01% | -11.75% | 4.19% | 1.46% | 9.44% | 20.03% |

| Global Stocks | 15.90% | 21.90% | -18.00% | 23.90% | 18.70% | 12.48% | 17.31% |

| Real Estate | -9.50% | 25.20% | -24.30% | 9.90% | 1% | 0.46% | 18.80% |

| Investment Grade Bonds | -11.14% | -1.57% | -18.01% | 9.27% | 0.99% | -4.09% | 10.65% |

| Speculative Bonds | 7.10% | 0.50% | -12.50% | 13.40% | 2.90% | 2.28% | 9.60% |

| Deposits | -0.59% | -0.69% | -0.15% | 2.66% | 3.17% | 0.88% | 1.88% |

Overall, real estate, which is traditionally considered a safe long-term investment, has been quite unpredictable during this period with an average return of only 0.46% and large fluctuations. Meanwhile, bonds, which have historically been a safe haven for investors, show even negative average returns in this five-year period (-4.09% for investment-grade bonds and 2.28% for speculative bonds), but with small fluctuations (around 10%). Therefore, it can be said that bonds are a safer investment solution than stocks, but at the same time these small fluctuations have yielded around 0 or negative returns.

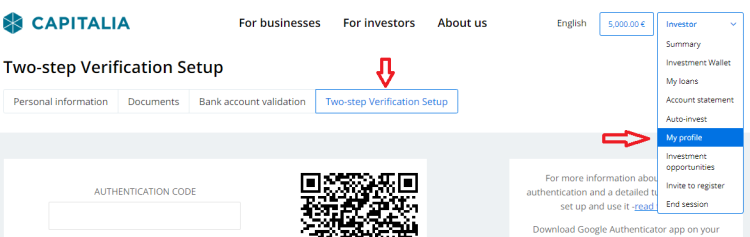

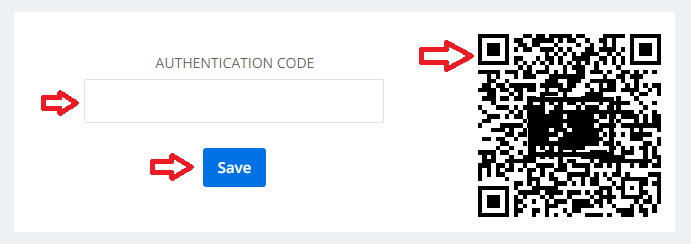

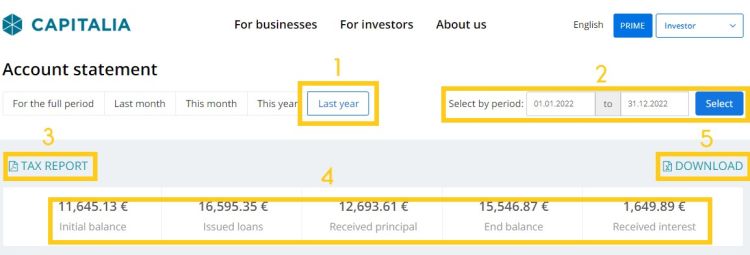

It's worth remembering that investments in financial markets are not the only investment opportunity, which is why this review also includes business loans through the Capitalia crowdfunding platform. Interestingly, such loans have brought investors the second-best return (10.97%), following global stocks, and provided the lowest return fluctuation (1.52%). Business loans don't have daily stock market prices and constant value fluctuations, so investment in such an instrument could be suitable for an investor who doesn't want stress but desires good and predictable results.

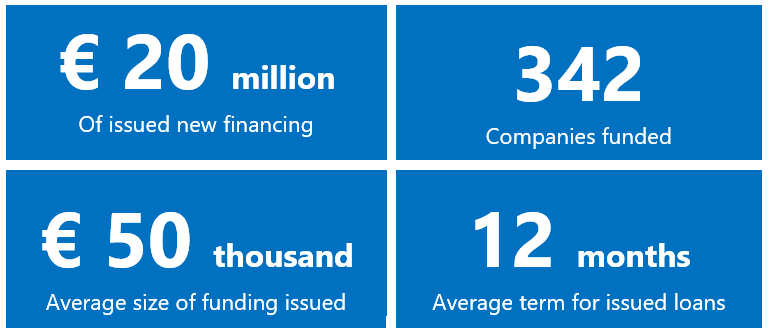

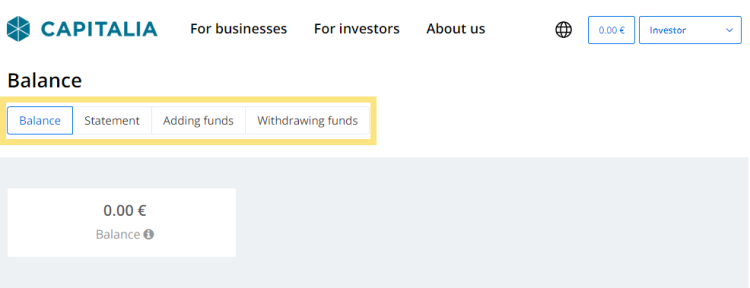

The Capitalia platform now already has more than 1,700 investors, mainly from the Baltic countries. Among the investors on the platform are both institutional investors (such as Signet Bank) and a number of business owners and management-level employees. Each loan project can be invested in from EUR 200, which allows for a well-diversified (25 projects) portfolio with just a EUR 5 thousand investment. Among the companies financed through the platform are recognizable companies such as Pure Chocolate, Stenders, and Aerodium.

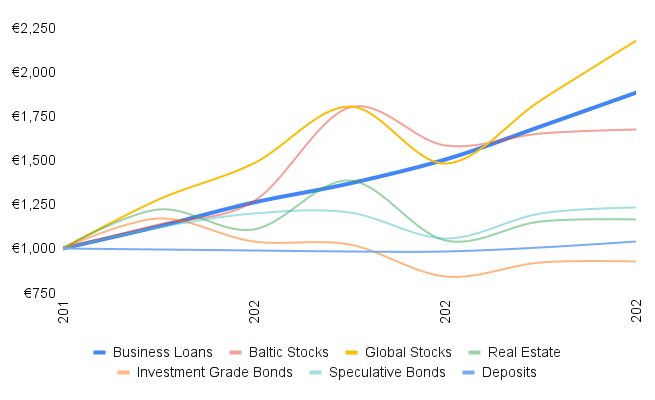

Given the difference in results for each investment category, it's interesting to observe how investment choices impact the total amount of savings. The graph below shows how the value of EUR 1000 investments in each investment would have changed over the past five years.

It's evident that investments in stocks have provided investors with very good returns, though requiring them to accept fairly significant fluctuations in investment value. Meanwhile, for investors who want to maintain peace of mind but ensure almost equally good returns, it's worth evaluating the opportunities offered by crowdfunding platforms to lend to small and medium-sized enterprises in the Baltic states.

Answering the question posed at the beginning of the article - where is there currently the least risk and greatest profit potential for investing? If the goal is to maximize profit and you're not afraid of higher risk, then the stock market is still the main path to high returns. However, if stability with attractive returns is the priority, business loans can be an excellent alternative to traditional investments.

in the public databases of the Enterprise Register and the Bank of Latvia.

in the public databases of the Enterprise Register and the Bank of Latvia.

.png)

.png)