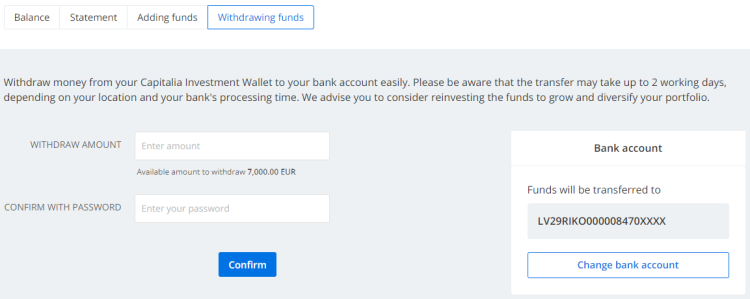

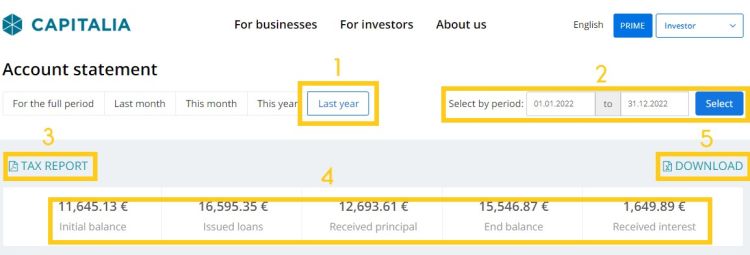

Export Wallet statement & import to P2P Dash tool

This tutorial shows how to export your Wallet statement into excel file and use it for importing in P2P Dash tool. Learn more

This tutorial shows how to export your Wallet statement into excel file and use it for importing in P2P Dash tool. Learn more

In the first three quarters of 2025, Capitalia reported a turnover of EUR 1.35 million. Operating revenue remained stable, and a modest loss of EUR 11 thousand was accumulated. Learn more

In order to comply with current regulatory requirements, Capitalia must collect and regularly update certain information relating to the identity of its users. This is part of the KYC (Know Your Customer) process, which aims to enhance security and combat money laundering and terrorist financing. Learn more

On operating results

In the first three quarters of 2025, Capitalia reported a turnover of EUR 1.35 million. Operating revenue remained stable, and a modest loss of EUR 11 thousand was accumulated. Financing activity was slower in the third quarter of 2025, and issued funding was lower compared to Q2. However, at the time of this report, the last quarter of the year started very strongly, with a record monthly funded amount of EUR 3 million reached in October.

On key events

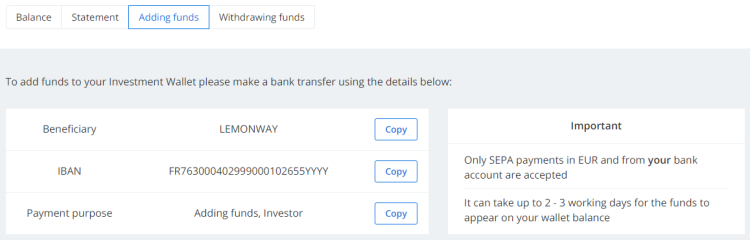

In the third quarter of 2025, we managed to issue a funding amount of EUR 4.0 million (EUR 5.1 million in the second quarter of 2025). We continued to test the lending environment and opportunities in Finland. A significant effort has been made to change the integration with the payment services provider Lemonway due to regulatory requirements. In alternative fund management, we did not have any exits or other notable events.

On plans for the next quarter

The last quarter of this year started with a very strong business financing activity, and we expect it to continue this way. We have completed all the new hires planned for this year. We continue developing a number of important features for our platform investors

The full financial report is available after login on our Investor relations page (available for logged in users).

In order to comply with current regulatory requirements, Capitalia must collect and regularly update certain information relating to the identity of its users. This is part of the KYC (Know Your Customer) process, which aims to enhance security and combat money laundering and terrorist financing.

This process is carried out in partnership with Lemonway, a payment institution authorised in France and supervised by the ACPR (Bank of France), our official payment service provider.

In the next few days, you will receive a secure email from Lemonway inviting you to complete or confirm your personal information. This step is essential to continue using your account and remain compliant with European regulations(in particular the PSD2 directive and AML/CFT legislation).

In the form sent by Lemonway, some information might be stated in French, as it is a French-based company. Please do not get confused by that and use the Google Translate web extension for translating to a language of your preference.

If you have any questions or concerns, please do not hesitate to contact our customer support team at the following address: support@capitalia.com. Thank you for your understanding and cooperation.

FAQ on recertification

In September 2025, our partner, authorized payment institution Lemonway, will perform its client recertification process to comply with the newest KYC regulations. This process will require action from all Capitalia clients as well who will need to update their information on Lemonway interface.

What is recertification? - Recertification means updating and confirming your personal or company information so it remains accurate and compliant with European financial regulations. This process is part of the KYC (Know Your Customer) requirements designed to protect your account, prevent identity fraud, and combat money laundering and terrorist financing.

Our trusted payment partner Lemonway, authorised and supervised by the ACPR (Bank of France), securely collects and verifies this information.

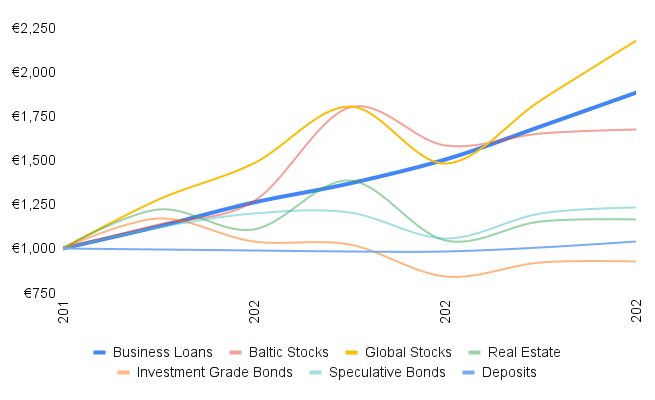

How will the recertification happen? - You will receive a secure, personal link from Lemonway via email. You will receive a secure, personal link from Lemonway via email. The sender will be no-reply <no-reply@lemonway.com>. The link that is shown if you move the mouse over the button will start with https://e-eu.customeriomail.com/. The site that opens on the click is collect.ondorse.co.

This link will take you to a protected online portal where:

The process only takes a few minutes and can be completed from your computer or mobile device.

What information do I need to update?

For individuals:

For companies:

The form is shown not entirely in English

For best results, we suggest staying in the English language, as it seems other languages are not fully supported yet, even if available. There could be some details, explanations or choice options in another language; we have reported the issue to Lemonway.

What is the real deadline?

Two different dates were communicated via emails. October 31st and November 15th. Please be informed that the real actual deadline is November 15th, 2025.

Not possible to change the country of incorporation (companies)

This happens when the Beneficial owners’ country initially was different from the Country of incorporation of the Company. In these individual cases, please contact support@capitalia.com. We will coordinate with Lemonway and a new portal for recertification will be created for you.

Unclear what documents to upload

When any new document is needed, it's clearly stated, however, the document part is visible in all cases. If you do not see any details what document to upload, please do continue to next step without uploading documents.

Did not receive an email from Lemonway

Some users reported that these emails were sent to their SPAM folder, please check there. Otherwise, please do not worry. In some circumstances Lemonway had all required KYC information and your account could have been skipped. Lemonway does send reminders every 15 days as well.

To avoid interruptions to your services, please complete your update as soon as possible once you receive the secure email from Lemonway.

Whom can I contact for more information? - If you have any additional questions that this page does not cover, please get in touch with us by writing to support@capitalia.com or calling +372 5864 0880.

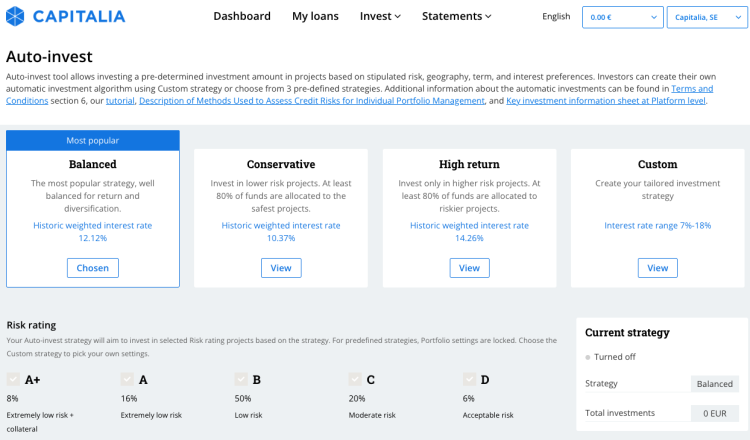

| 2020 | 2021 | 2022 | 2023 | 2024 | Average | Fluctuation | |

| Business Loans | 11.92% | 8.55% | 10.11% | 12.05% | 11.73% | 10.87% | 1.52% |

| Baltic Stocks | 11.27% | 42.01% | -11.75% | 4.19% | 1.46% | 9.44% | 20.03% |

| Global Stocks | 15.90% | 21.90% | -18.00% | 23.90% | 18.70% | 12.48% | 17.31% |

| Real Estate | -9.50% | 25.20% | -24.30% | 9.90% | 1% | 0.46% | 18.80% |

| Investment Grade Bonds | -11.14% | -1.57% | -18.01% | 9.27% | 0.99% | -4.09% | 10.65% |

| Speculative Bonds | 7.10% | 0.50% | -12.50% | 13.40% | 2.90% | 2.28% | 9.60% |

| Deposits | -0.59% | -0.69% | -0.15% | 2.66% | 3.17% | 0.88% | 1.88% |

Find out what changes Capitalia has implemented as required by the ECSP regulations and how it impacts investors' experience. Most of the changes concern investor protection and all of it is approved by the regulating body Bank of Latvia to ensure they match the EU regulations.

Additional due diligence checks for new projects ✅

In addition to the risk scoring that Capitalia is using, now Project owners have a requirement to submit additional information for due diligence checks. This includes such items as proof of impeccable criminal records and information about past payment defaults to any creditors of the project owner.

Publication of Credit scoring and loan pricing policy ✅

Our published Description of Credit Risk Scoring Model and Loan Pricing Methods will improve transparency with our investors. This document has been published in the Risk management section of the website. Investors now can better understand how we score projects and set pricing. Capitalia strives to ensure fair and appropriate pricing for the loans originated on the Platform.

Conflict of interest ✅

Our published Conflict of Interest Policy covers important aspects and changes in this field coming from regulation. To date employees of Capitalia were active investors on the platform, however, their investments will be limited to only Auto-invest strategies. Also, special rules for platform-related company Capitalia Investment Holding, AS, were laid out, allowing it to invest 2.5% of the target financing amount in every project. Capitalia has been co-investing in projects since the very beginning and we believe continuing it ensures the alignment of interest of Capitalia and investors.

Key Investment Information Sheet (KIIS) publication on new projects ✅

A new document now appears on new projects called "Key Investment Information Sheet" (in short “KIIS”). Every licensed crowdfunding platform must provide such a sheet for each project and the goal is that investors could easily compare projects between different platforms. This document includes details about the project owner, a description of risks, key financials, and similar.

Knowledge assessment test ✅

Capitalia implemented an entry knowledge assessment test that all investors must take. Test results will be valid for 2 years.

Net worth calculation and loss simulation ✅

In addition to the knowledge test, a net worth calculation and a loss simulator are

required for each investor. This will help investors to understand better the risks involved in crowdfunding. These details are used only for showing the relevant risk warnings and applying correct limits.

Risk warnings based on net worth and lending amounts ✅

Based on the ability to bear loss simulation test, we started showing additional risk warnings to investors when making new investments larger than 5% of their net worth (or EUR 1,000, whichever is lower). These warnings will raise the awareness of investors and provide a choice to continue by approving that they do understand the potential risks.

On operating results

In the first half of 2023, Capitalia reported a turnover of EUR 705 thousand and losses of EUR 52 thousand. The operating results were negatively impacted by extraordinary one-off expenses which resulted from the sale of a subsidiary holding a brokerage license. As part of the costs associated with opening, and maintaining the subsidiary as well as obtaining the license were not fully amortized, they were booked at the moment of subsidiary sale. Financing activity remained strong in the second quarter of 2023. During the first half of 2023, we managed to issue a funding amount of EUR 13.03 million (EUR 9.85 million during the first half of 2022).

On key events

In the second quarter of the year, Capitalia issued new financing in the amount of EUR 5.6 million (EUR 7.43 million in the previous quarter). Among the financed businesses during this period were, for example, such companies as Aeonpump (manufacturing), MIG Baltic (wholesale and retail trade), and Selva Būve (construction).

In alternative fund management, we have made 3 new investments from our cost-efficient Baltic bond fund and acquired bonds of Integre Trans (a Lithuanian logistics company), Akropolis Group (a Lithuanian retail property development company), and Eleving loan-backed securities - a Latvian finance company - on the Mintos Marketplace platform.

On plans for the next quarter

We believe that over the third quarter of 2023 the business financing activity will continue strongly despite the still ongoing economic concerns. We continue to observe that companies are adjusting to working in the still high inflation as well as higher interest rates environment. Our financing is becoming more attractive as interest rates at commercial banks have increased and we expect to see good projects for financing throughout the year.

The full financial report is available after login on our Investor relations page (available for logged in users).

| Country | Double tax treaty rate (%) | Country | Double tax treaty rate (5) |

| EU | Non-EU | ||

| Austria | 10 | Albania | 10 |

| Belgium | 10 | Armenia | 10 |

| Bulgaria | 5 | Azerbaijan | 10 |

| Croatia | 10 | Belarus | 10 |

| Cyprus | 10 | Canada | 10 |

| Czech Republic | 10 | China | 10 |

| Denmark | 10 | Georgia | 10 |

| Estonia | 10 | Hong Kong SAR | 10 |

| Finland | 10 | Iceland | 10 |

| France | 10 | India | 10 |

| Germany | 10 | Israel | 10 |

| Greece | 10 | Japan | 10 |

| Hungary | 10 | Kazakhstan | 10 |

| Ireland | 10 | Korea (ROK) | 10 |

| Italy | 10 | Kosovo | 10 |

| Lithuania | 0 | Kuwait | 5 |

| Luxembourg | 10 | Kyrgyzstan | 5 |

| Malta | 10 | Mexico | 10 |

| Netherlands | 10 | Moldova | 10 |

| Poland | 10 | Montenegro | 10 |

| Portugal | 10 | Morocco | 10 |

| Romania | 10 | North Macedonia | 5 |

| Slovakia | 10 | Norway | 10 |

| Slovenia | 10 | Qatar | 5 |

| Spain | 10 | Saudi Arabia | 5 |

| Sweden | 10 | Serbia | 10 |

| Singapore | 10 | ||

| Switzerland | 10 | ||

| Tajikistan | 7 | ||

| Turkiye | 10 | ||

| Turkmenistan | 10 | ||

| Ukraine | 10 | ||

| United Arab Emirates | 2.5 | ||

| United Kingdom | 10 | ||

| United States | 10 | ||

| Uzbekistan | 10 | ||

| Vietnam | 10 | ||

in the public databases of the Enterprise Register and the Bank of Latvia.

in the public databases of the Enterprise Register and the Bank of Latvia.

In this article, we’d like to highlight the significant advantages of diversification in investing. Lending to businesses inherently carries the risk of not receiving back some or even all of the amount you’ve lent. To mitigate this risk, it’s crucial to adopt a strategy of consistent investment over time and across a range of projects. By doing so, you can achieve two key objectives:

Minimizing the impact of individual loan performance on your overall return.

Avoiding the pitfalls of poor timing.

The value of diversification is clearly demonstrated by the historical returns data from our platform. When we factor in loan losses and provisions for potential losses, we can see the following portfolio returns based on the number of loans invested in by each investor:

Chart: Portfolio Return on Investment vs. Number of Loans Invested

.png)

From this graph we can draw several clear conclusions:

All investors who have invested in 27 or more projects have achieved a positive net return above 5%;

Some investors that have built a relatively small portfolio of up to 20 loans can get higher than average returns, however, most small portfolios will deliver lower than average results;

Investing in all loans by Capitalia would bring a return of 10% (investors who have invested in more than 130 projects have a net return from 9.5% to 10.5%);

In many cases investors that have built portfolios with over 25 loans but have reported below average returns, have invested much higher than their average amounts in a few riskier loans;

Only 13 out of 800 active investors have a negative return.

With these conclusions in mind we strongly recommend you to follow the following principles when investing in Capitalia (or anywhere else for that matter):

Aim to continuously have a portfolio of at least 25 investments;

Invest a similar amount in each project;

Make smaller investments but invest in a larger number of projects;

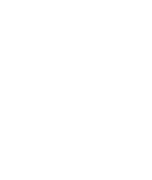

Use our Auto-invest tool for headache free automatic diversification.

Below we provide a similar chart, but with returns of investors who have invested in more than 25 projects

.png)

Capitalia encourages companies to think about and implement good environmental, social and corporate governance (“ESG”) standards. That is why already since 2018 ESG factors have been important components of Capitalia’s scoring and pricing for financing small and medium businesses in the Baltic countries. As of the beginning of the year 2022 we have increased the weight of these factors and now companies with high marks for leading environmental, social and governance practices can get even cheaper access to business loans.

As the next step we plan to communicate our ESG scoring results also through our co-investment platform, allowing investors to identify the companies that are the most conscious of the environmental and social impacts.

Capitalia is expanding its financing product offering to include leasing of heavy machinery and equipment to agricultural, manufacturing, and industrial sector companies. We aim to continue to complement the products offered by the traditional banks and our addition of leasing provides another useful tool besides business loans and invoice purchasing for businesses to fund expansion and operations. To reach out to potential purchasers of heavy machinery, we have concluded a partnership with Mascus, the leading marketplace of agricultural and industrial machinery in the Baltics.

Leasing of equipment will be offered for up to EUR 500,000 and up to 36 month period. Capitalia can fund also 100% of the equipment's value. With our streamlined evaluation process, we are able to provide fast financing offers in 1-3 days. To find out more, please reach out to us by calling or sending an email to financing@capitalia.com.

On operating results

In 2017 Capitalia reported total revenues of EUR 1,197 thousand, which is an increase by 30% compared to the year 2016. In the current period we achieved profit of EUR 36 thousand that more than covers losses of the previous financial year. We have managed to achieve a solid growth in the loan portfolio with total amount of EUR 4,881 thousand as of the end of the reporting year.

On key events

During year 2017 we have made significant improvement in organization management, updated and improved our operating procedures as well as successfully finished establishment of investment manager team in Estonia. Also, in the fall of year 2017 we have launched publicly our co-financing platform Capitalia.com through which we allow investors to invest in the Baltic companies along with us. In the first two months since the launch of the platform we have already financed 6 companies for the total amount in excess of EUR 500 thousand.

On plans for the next quarter

In the following quarter Capitalia will concentrate on growth of the investment portfolio, particularly in Estonia. Also we will strongly focus on bringing in more financing projects though our co-financing platform Capitalia.com.

|

Capitalia microloan

|

vs.

|

Traditional business loan *

|

| Basic documentation, all information exchange electronically | Application Requirements | Additional documentation to be prepared |

| Short online application form and a telephone interview | Application Process | Detailed application form online and a consultation at Customer Service Unit |

| One to five working days | Time to Decision | A week or longer |

| Solutions available for non-standard loan terms and conditions, early repayment wthout penalties | Flexibility | Standard solutions available, early repayment charge applies |

| Available for companies with short operating history and small or illiquid collateral | Availability | Available for companies with minimum two year operating history, strict collateral requirements |

| Direct communication wit the Loan Manager | Customer Service | Call center and contact form based customer service |

Sandwich school

SIA “Sviestmaize” (sandwich in English) co-owner Edgars Runcis did not choose the name of his company at random – his first business in 2009 was indeed the sandwich business. The idea was to sell self designed sandwiches – initially a café on Brivibas street then a kiosk on Barona street, and after that, following significant transformation, a kitchen service at NABACLAB. The first café was serious learning experience, especially when it comes to cash management and financial planning. Every next step provided Edgars with new insights about the restaurant business and eating habits of Latvians, for example, they do not like to eat a sandwich and walk down the street and the menu is considered adequate if it has chicken meat and vegetarian options.

A place were to sit down

In 2011 he opened the café Pasēdēt (Sit Down). As the owner describes in his Facebook page, this is the place to sit down, eat, drink and party on weekends. Until recently, the entrepreneur financed his operations from savings and operating cash flow except for investor financing which was raised for the launch of the initial project. However it is very difficult for small business owners to make significant investments without the help of outside financing. Bank loans for such cases most of the time are not available. This was the case with expansion plans for Pasēdēt – the bank loans were not available. Thanks to Capitalia’s POS credit – a loan facility targeted at retail businesses, Pasēdēt was able to finance the construction of the second floor. POS credit is especially convenient for businesses whose clients mostly pay with payment cards, because the repayment of the loan is automatic and Edgars does not have to follow the payment schedule.

A leader, not a boss

Edgars Runcis is very passionate about his business and plans to expand within the existing location. He only gets discouraged when he is faced with bureaucracy to obtain each additional permit to continue his operations. Speaking about his future plans he does not plan to open any new locations as he wants to focus on the existing place. Instead, he keeps working alongside with his employees at the bar and sees himself more as a leader rather than a boss. For example, he is fine with skipping some fun events once in a while when is his turn at the bar, but he is telling this with joy, as this was the approach he chose himself.

Capitalia is the leading financer for small and medium enterprises in the Baltic sea region. Operating since 2007 we have financed more than 5000 businesses investing over EUR 100 million in their development.

Crowdfunding services are provided by Capitalia, SE, operating under authorization from the Bank of Latvia. Investment in crowdfunding projects entails risks, including the risk of partial or entire loss of the money invested.

Partner of Lemonway, a European payment institution accredited in France by the ACPR (CIB 16568).