Ar komercķīlu nodrošināts finansējums augošam presformu ražošanas uzņēmumam Igaunijā (II)

Kopsavilkums

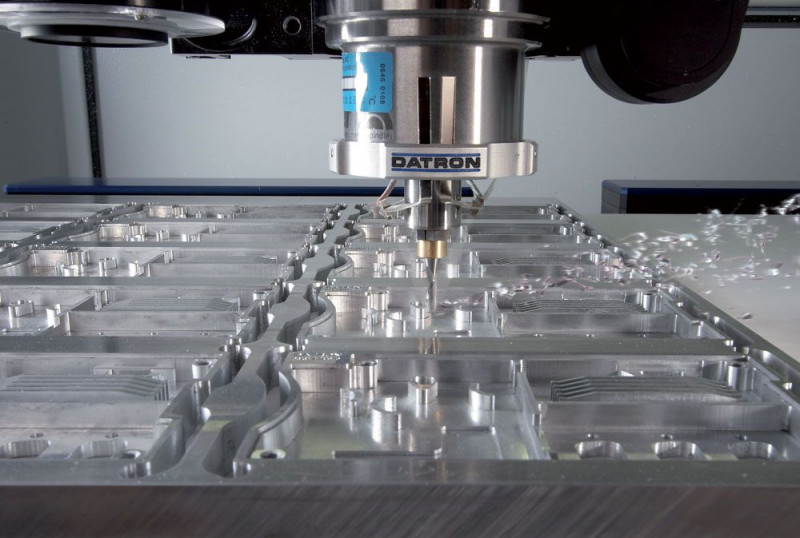

Founded in 2005, the Company is producing dies and injection molds for manufacturing equipment. Injection mold is a changeable part of manufacturing machinery to produce various types of plastic details. The main clients of the Company are numerous producers of plastic goods worldwide. The export of the Company comprises up to 90% of the total revenue. The Company was acquired by the new shareholder at the end of 2019 and since then the Company's monthly turnover has more than tripled. The Company has an experienced team and all the machinery necessary to maintain the current growth pace and reach the prognosis set for the year 2021.

The Company has received a significant export order for the production of injection molds. The production cycle takes up to 6 months and the customer will pay in parts after the molds will be completed. Although the Company has an active loan from Capitalia with the remaining principal of EUR 187,720, the upcoming order requires additional working capital and preferred adjustments in the existing repayment schedule. Therefore, the Company is seeking additional financing of EUR 311,475 for 18 months. The loan part of EUR 187,720 will be used to refinance the existing Capitalia loan. The remaining amount will be used for working capital purposes to settle with suppliers for materials. The loan will carry an 11.52% annual interest rate (0.96% monthly) with monthly interest payments and principal repayment starting from the seventh month. The loan is secured with a pledge on the Company's assets with a book value of EUR 3.27M, a personal guarantee of the beneficial owner, and a pledge on 20% shares of a profitable related company with EUR 3.5M equity capital. The related company is successfully operating in the metalworking and manufacturing industry since 2009.

The Company is a repeat client of Capitalia that has serviced the active loan with an excellent payment discipline having repaid EUR 125,030 of principal so far.

There are a number of factors that make lending the Company an attractive opportunity and the main highlights are as follows:

- The loan is secured with a pledge on the Company’s assets with a book value of EUR 3.27M and a personal guarantee of the beneficial owner.

- As an additional guarantee pledge on 20% shares of a profitable related company with a EUR 3.5M equity capital is provided.

- The Company has 16 years of experience in the injection mold manufacturing field.

- The Company has not felt any impact of Covid-19 due to its customers being large manufacturers of mass production.

- The monthly turnover of the Company has increased by 3 times since the ownership change in 2019.

- The Company is a repeated client of Capitalia servicing the active loan with an excellent payment discipline.

- The Company has an outstanding equity capital of EUR 2.65M.