Mortgage-secured financing for a real estate development and construction company (Stage I)

The Company, established in 2016, is part of a real estate development and construction group. It specializes in acquiring and subdividing land, developing infrastructure (access roads, electricity, gas), and subsequently selling individual land plots for private home construction. In addition, the Company also develops detached and terraced houses on these plots for sale or rental. Construction services are provided by a related group entity.

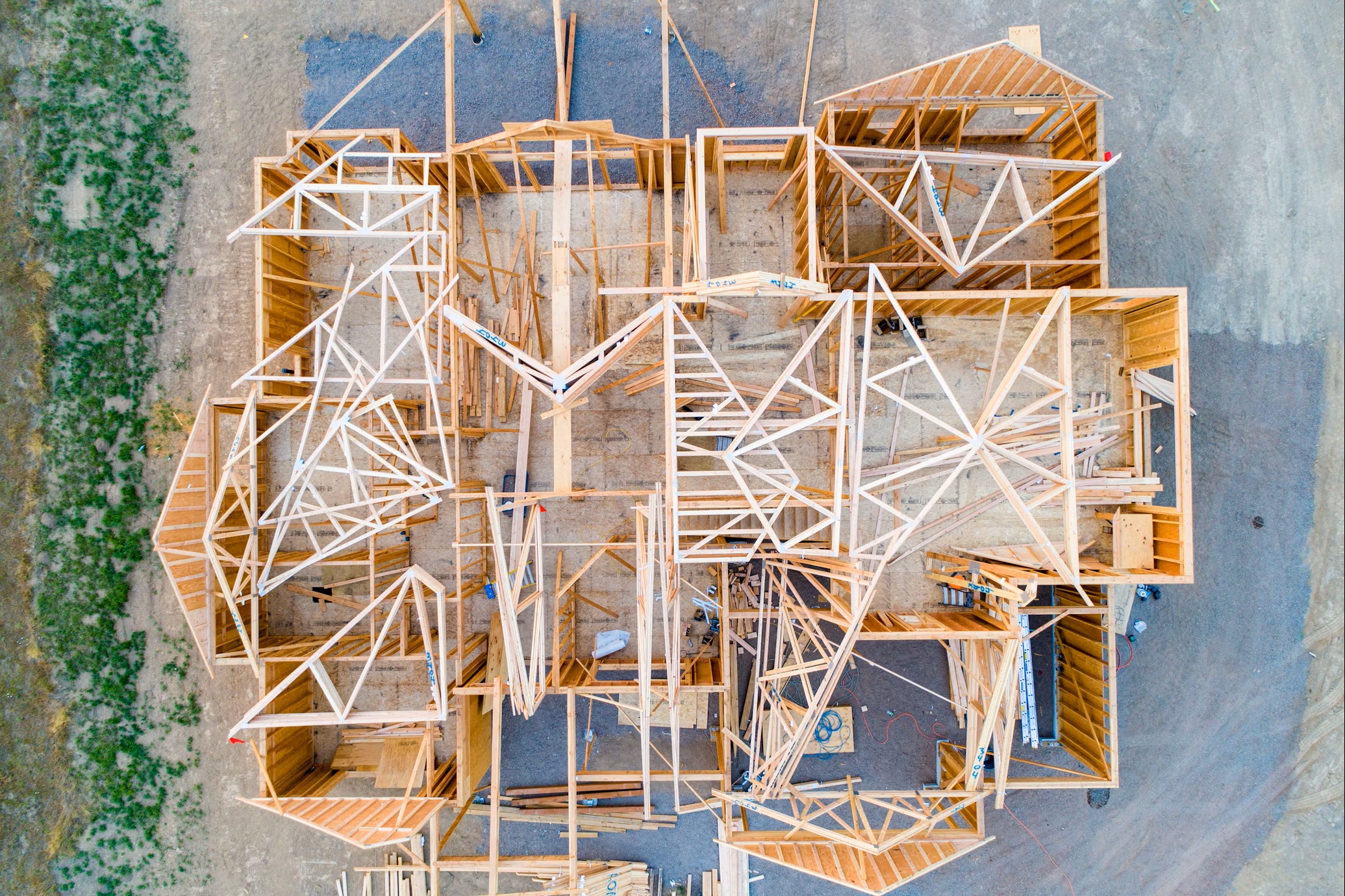

The Company is currently developing a private residential house – a developing residential village in a remote area of Ādaži city. The total estimated construction cost is EUR 276,000 (approx. EUR 1,880 per m²). The Company has already invested EUR 99,500 of its own funds into the project and now EUR 176,000 in financing is needed to complete the house.

Therefore, to proceed with the project, for the first financing tranche, the Company is seeking EUR 62,400 financing for 24 months to continue the construction of the house. The loan will carry a 11.76% annual interest rate (0.98% monthly) and it will be amortized at the end of the term from the sale of the developed residential house or by refinancing it to a commercial bank. The loan will be secured with a first-rank mortgage on the property under development with an initial market value of EUR 102,000 and an estimated future value of EUR 343,000. Resulting in a final LTV ratio of 52%. In addition, a related company and the owner of both companies will provide guarantees. The project risk rate is B (80 out of 100).

The approved limit for the Company is EUR 170,000, which will be issued in three tranches. All financing tranches will be secured with one - shared mortgage to the property under development in Ādaži, Garkalne parish, with a future value of EUR 343,000. These loans will be disbursed based on the collateral property value and the total loan exposure will not exceed 60% of the property value.

There are a number of factors that make lending to the Company an attractive opportunity and the main highlights are as follows:

- The loan is secured with the real estate under development with the current market value of EUR 102,000.

- The related company and the owner of both companies will provide guarantees.

- The Company’s group has 10 years of experience in the industry and a proven track record of successful real estate development projects.

- The final value of the pledged property after the completion is EUR 343 000 resulting in an LTV of 52% considering all the financing tranches.